how to avoid pennsylvania inheritance tax

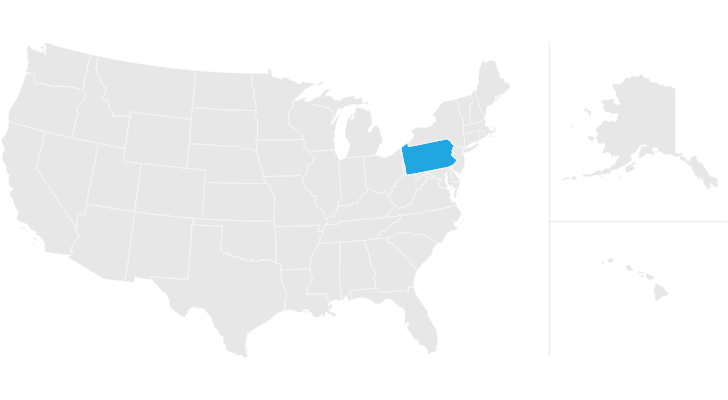

Gifts can be taxable but very few people ever have to pay a gift tax. The Pennsylvania estate tax is owed by out-of-state heirs for real property and tangible personal property located in the Keystone State.

Pennsylvania Estate Tax Everything You Need To Know Smartasset

You can cut the tax in half that way.

. If you still want to maintain control of it through an individual trustee you can create an irrevocable trust which will pass it tax-free. Buy Farmland and Agricultural Property. There is a 12 tax on transfers to siblings and a 15 tax on transfers to any other heir with the exception of charitable organizations exempt institutions and government entities that dont pay tax. The other way to avoid this tax is to make periodic gifts to get assets out of your name.

We can think of this one as the literal inheritance tax. You cannot simply avoid paying. There is no limit to the amount that can be gifted each year. Small family-owned businesses those that have fewer than 50 employees and assets valued at less than 5 million are also exempt from inheritance.

As mentioned Pennsylvania has an inheritance tax. Does Pennsylvania Have an Inheritance Tax or Estate Tax. The Pennsylvania legislature has carved out inheritance tax exceptions for certain kinds of property. Your heirs will inherit a tax-free income tax free inheritance tax free estate tax free.

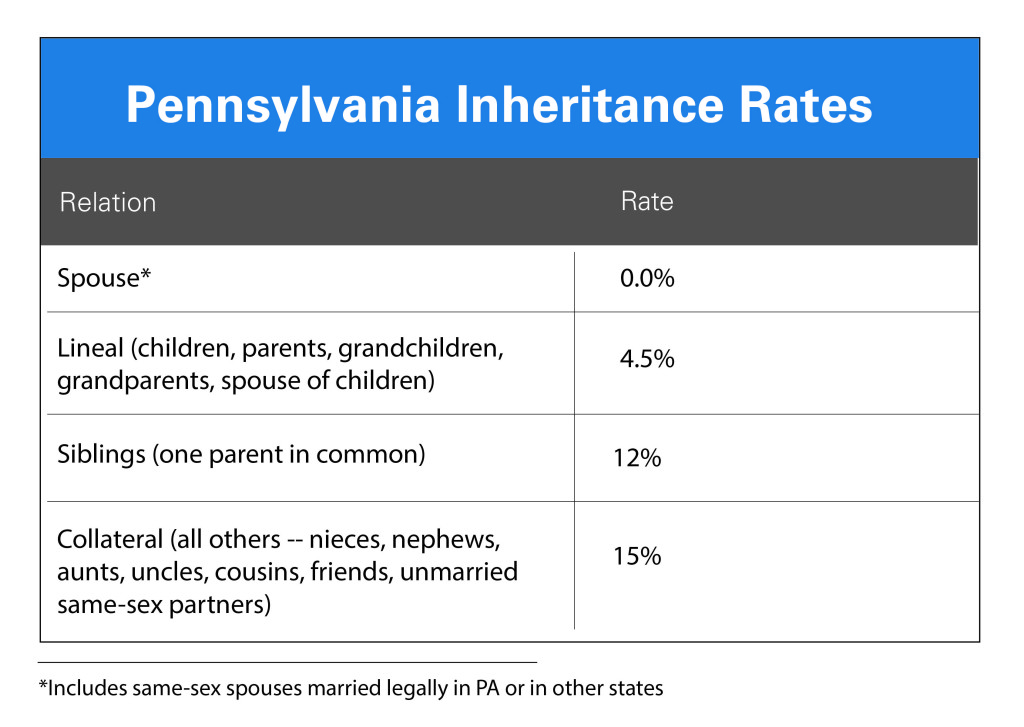

There is no estate tax in Pennsylvania. Method 3 to minimize or avoid PA inheritance tax. The inheritance tax applies when the person that died was a resident of Pennsylvania. The tax rate for Pennsylvania Inheritance Tax is 45 for transfers to direct descendants lineal heirs 12 for transfers to siblings and 15 for transfers to other heirs except charitable organizations exempt institutions and government entities that are exempt from tax.

When that happens only the value of their Pennsylvania assets are subject to the inheritance tax. Method 1 to minimize or avoid PA inheritance tax. There is no federal inheritance tax and is only assessed by the following 6 states. For further information and answers to commonly asked questions please review the brochure Pennsylvania Inheritance Tax and Safe Deposit Boxes.

It is important to make an asset joint. How to Avoid Pennsylvania Inheritance Tax. Well make you a fair all-cash offer. Submit your info on the form on this page or give us a call at 202 826-8179 and let us know a bit about the property.

It would also apply if the decedent lived out of state but owned property in Pennsylvania. Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individuals death. Do I have to pay taxes on an inheritance in PA. Inheritance taxes must be paid.

Following are some options to consider reducing inheritance tax for your heirs. Inheritance taxes are only imposed on any amount exceeding the threshold defined by each state. Non-spouse heirs can reduce the amount of inheritance tax they need to pay if the value of the inheritance is lower than the states minimum tax threshold. If inheritance tax is paid within three months of the decedents death a 5 percent discount is allowed.

1055 Westlakes Dr Suite 300 - Berwyn PA 19312. Well look at your situation and quickly evaluate the property. Wechsler or another estate planning law firm before engaging in any inheritance tax reduction strategy. Life insurance is generally exempt from PA Inheritance Tax.

The tax rate for Pennsylvania Inheritance Tax is 45 for transfers. Gifting Assets gifted more than 12 months prior to death are excluded from PA inheritance tax. This prevents you from signing over everything you own on your deathbed just to avoid paying the tax. Avoiding the Pennsylvania Inheritance Tax Through Lifetime Transfers.

As a Montgomery County resident at your fathers death all assets he leaves you at death except life insurance will be subject to the Pennsylvania Inheritance Tax at the 45 childrens rate. This tax is served not on the estate but on the specific inheritances going out to each of the decedents listed heirs. Farmland is exempt from inheritance tax as long as the land is inherited by family members and continues to be used for agriculture for seven years. You should consult with the Law Offices of Jeremy A.

However the inheritance of jointly owned property from the decedent to his or her surviving spouse isnt included in this tax. This means that even if you live in one of the above states you still might not be subject to. What happens if you dont pay inheritance tax in PA. To avoid heirs having to pay heavy inheritance taxes some estate planners create trusts upon death so that the decedent bequeaths some money to charity in addition to bequeathing to hisher children amounts of money that are equivalent.

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

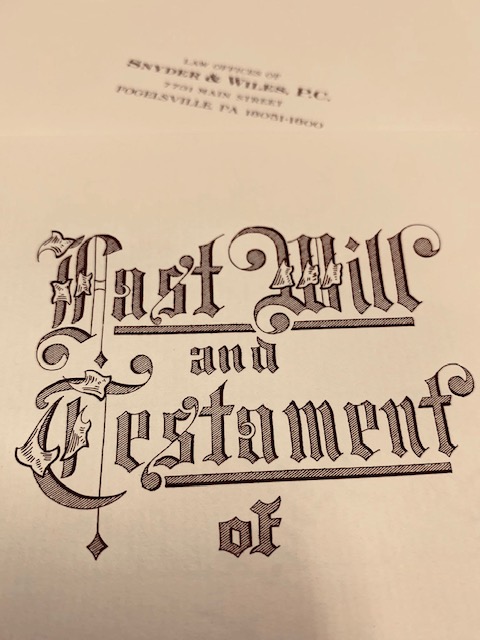

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

How To Plan A Trip To New Zealand With Kids Revocable Trust Estate Planning New Zealand Travel

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Pennsylvania Inheritance Tax And Other Factors When Inheriting A Home

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Posting Komentar untuk "how to avoid pennsylvania inheritance tax"